louisiana inheritance and estate transfer tax return

Separate property in louisiana inheritance law. The Estate Transfer Tax No current collections of the tax Equal to the maximum tax credit for state estate or inheritance tax allowed on the federal estate tax return Pick-up tax Since.

Create A Living Trust In Louisiana Legalzoom

Executors must file the following if the estate exceeds a value of 11180000.

. R-3318 204 Louisiana Department of Revenue Mark one. United States Estate and Generation-Skipping Transfer Tax Return is an Internal Revenue Service IRS form used by an executor of a decedents estate to calculate the. Schedule IV Tax.

Form IETT-100 Taxpayer Services Division Original return P. Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. While the estate is responsible for paying estate taxes beneficiaries must pay inheritance tax.

Louisiana does not have an. Louisiana Inheritance and Gift Tax. The portion of the state death tax credit allowable to Louisiana that exceeds the inheritance tax due is the state estate transfer tax.

Inheritance and Estate Transfer Tax Return Mark one. Box 201 Amended return Baton Rouge LA. Original return Amended return Partial return Date of originalaaa Real estate Louisiana property only.

The estate would then be given a federal tax credit for the. The Economic Growth and Tax Relief Reconciliation Act. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

Louisiana Inheritance Tips Advice Rabalais Estate Planning Llc

/state-no-estate-tax-2000-654db88bef32439ab403da6132265b5a.jpg)

States With No Estate Or Inheritance Taxes

How Do State And Local Property Taxes Work Tax Policy Center

Free Louisiana Last Will And Testament Template Pdf Word Eforms

How Do State And Local Property Taxes Work Tax Policy Center

Louisiana Inheritance Tax Estate Tax And Gift Tax

Estate Planning For Louisiana Attorney John R Harris

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Do It Yourself Succession Louisiana Probate Advance

.jpeg)

When Succession Is Required In Louisiana Scott Vicknair Law

Louisiana Petition For Possession And Affidavit Of Valuation And Detailed Descriptive List Louisiana Possession Us Legal Forms

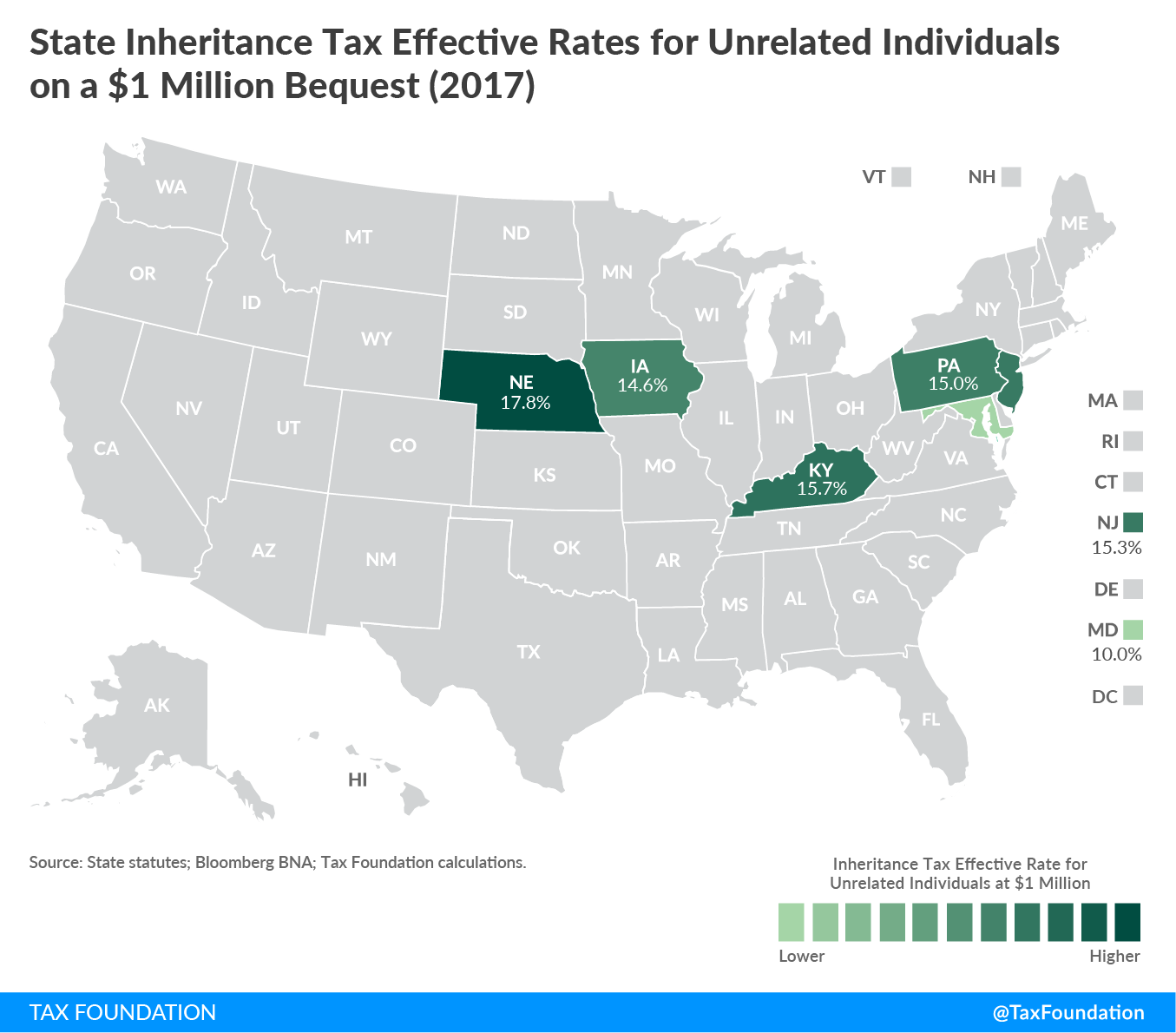

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Louisiana Inheritance Tax Estate Tax And Gift Tax

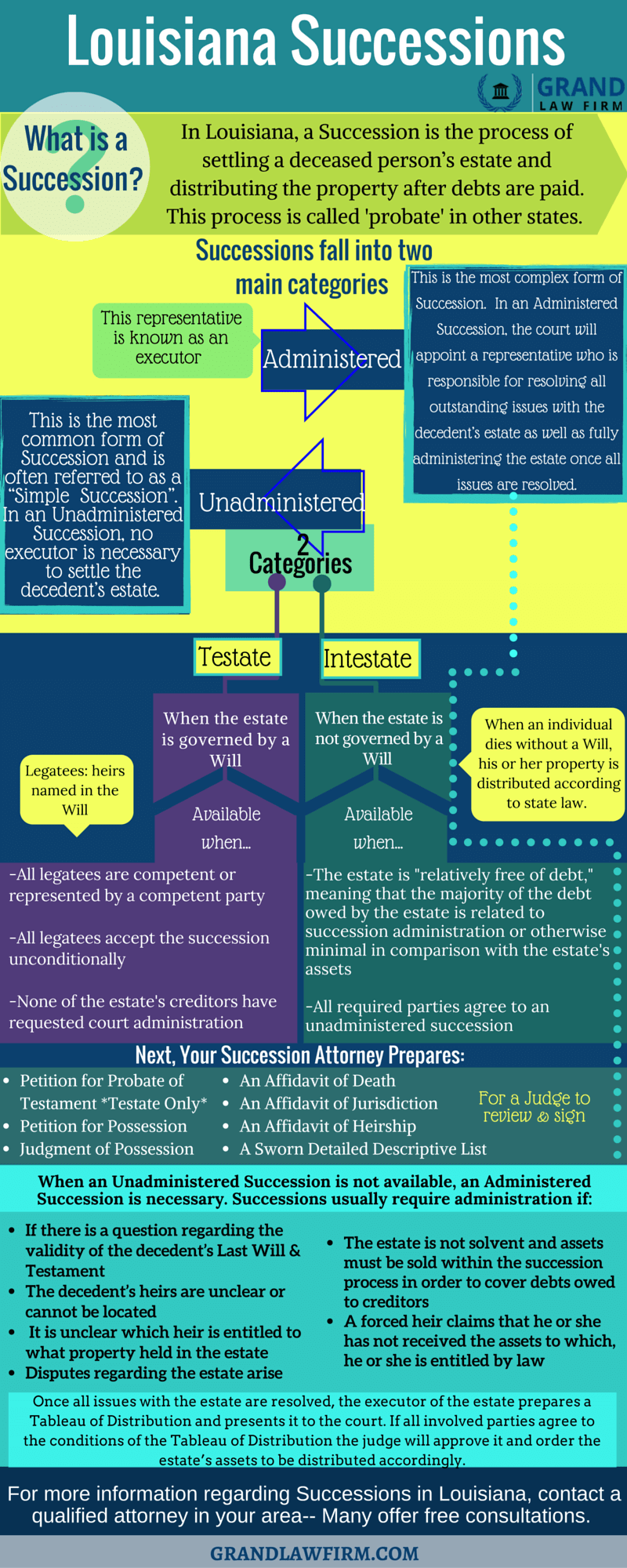

Louisiana Successions A Brief Explanation